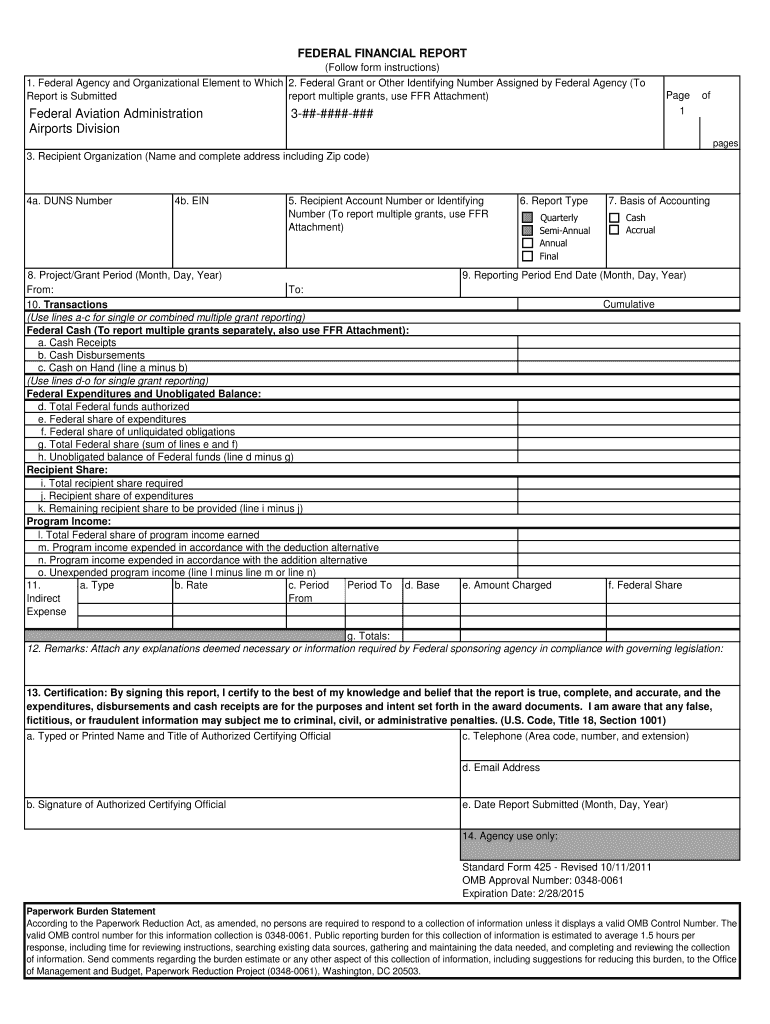

Who needs an SF 425 Form?

A Form SF 425 is a Federal Financial Report, also labeled the FFR, issued by the OMB — Office of Management and Budget. Those who receive federal funds are obligated to file this form to report on the status of grant funds or agreements of assistance.

What is the SF 425 Form for?

The SF-425 form is a consolidated federal cash and expenditure statement. It is required by the OMB to track the status of the financial data related to a particular federal grant award. In fact, the Federal Financial Report (FFR) Form SF 425 has replaced two other reports: the Federal Cash Transactions Report (form SF-272) and the Financial Status Report (form SF-269). The FFR creates government-wide standards for reporting periods and due dates.

Is the SF 425 Form accompanied by other forms?

There is no need to supplement it with any other documents with the 425 PDF form. If the report is intended to cover multiple grants, the FFR is required for each grant.

When is the SF 425 Form due?

The form’s SF-425 due dates can vary depending on the period type of the federal report. The SF 425 reports can be annual, semi-annual, quarterly and final. Quarterly and semi-annual reports must be submitted not later than 30 days after the reporting period has ended. The submission of an annual report is expected not later than 90 days after the reporting period has elapsed. Final reports are due not later than 90 days after the project or grant period end date.

How do I fill out the SF 425 Form?

The Federal Financial Report is a one-page fillable form. Nonetheless, it requires careful and thorough consideration of compulsory contents and calculations.

The upper part of the completed form is designed to furnish the necessary information about:

- where the report is being submitted,

Grant (identifying number),

Recipient organization (name and full address),

DUNS number and EIN,

Recipient account number (to indicate how the recipient organization identifies the grant),

Type of the report,

Accounting basis,

Period of the project or grant funds (start date, end date, and reporting period end date),

Transactions (requires an indication of the cumulative amount received since the inception date up to end date of the reporting period).

They are subdivided into several categories:

- Federal cash,

Federal expenditures and obligated balance,

Recipient share,

Program income,

Indirect Expense,

Remarks,

Certification.

Where do I send the SF 425 Form?

The completed SF-425 Federal Financial Report should be sent to the recipient's FMO (Financial Management Office). A copy of the report should also be made for the recipient’s records.